Award-winning PDF software

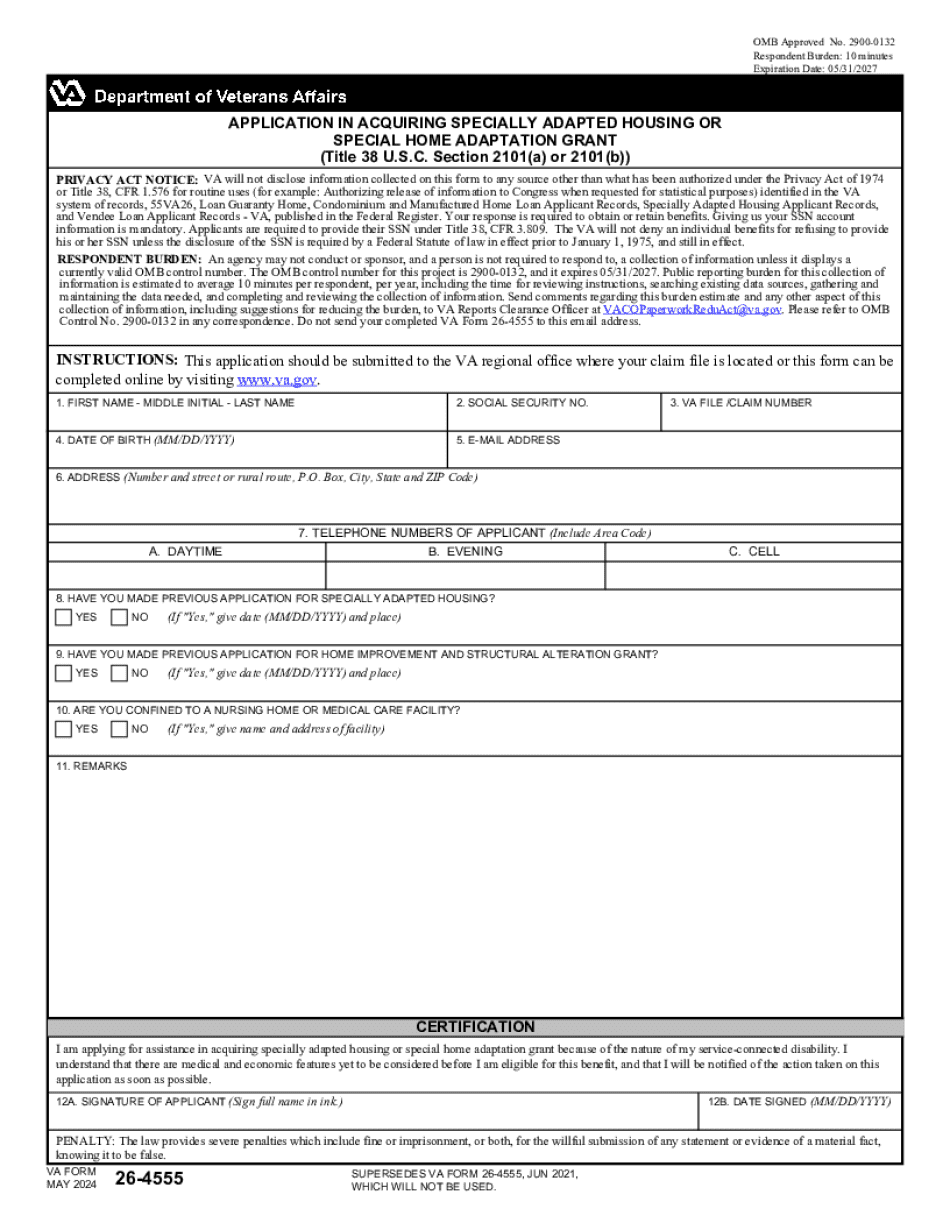

Va Form 26-4555: What You Should Know

How to Fill out a Tax Return: Form 433 Instructions PDF, Tax Year 2 Form 433-F 2, Fillable Online, Fillable, Fillable, Blank Form 1310, Statement of Receipt for Unused Business Excess Contributions. This form is used when a taxpayer overpaid a contribution to a qualified charitable organization. Form 1310 is used at the end of the year to report the excess to the Secretary of the Treasury for inclusion in a charity's Federal income tax return during the following tax year. Form 433-F is also used when a tax return for an individual returns less than the full tax due at the end of the following tax year. Form 433, Faxing Instructions for Tax Returns for Members of the Armed Forces The Form 433 and Form 433A Form EAT is used by military personnel if their employer pays them a paycheck less than their normal pay due each pay period, or fails to pay all the required minimum payments required by the Department of Defense Pay Scale. Form 433EAT is used if a military payer fails to pay in accordance with the applicable requirements described in section 1585, 1585a, 5703, or 8103 of title 10, United States Code. Form 433EAT is also used to report overpayments to the Secretary of Defense to cover overpayments due military personnel within the meaning of section 1582 of title 10, United States Code, as amended by section 1582(b)(1) of the National Defense Authorization Act for Fiscal Year 2025 (10 U.S.C. 2587 note) and Section 904 of National Defense Authorization Act for Fiscal Year 2025 (Public Law 113-291). Form 433EAT includes the information required to electronically file a claim for credit or claim for refund under section 2667, 6013, or 6701 of title 10, United States Code or section 2701 of title 31, United States Code. Form 433EAT is designed to facilitate prompt recovery from the Department of Defense or the Department of the Treasury on behalf of members of the armed forces or noncivilian civilian employees. Form 1310, Statement of Receipt for Unused Business Excess Contributions (PDF), Tax Year Form 1310 is used when a taxpayer overpaid a contribution to a qualified charitable organization within 6 months before the close of the year.

Online alternatives assist you to to organize your document management and enhance the efficiency of one's workflow. Abide by the short handbook so as to finish VA Form 26-4555, stay clear of problems and furnish it within a timely fashion:

How to finish a VA Form 26-4555 internet:

- On the web site with all the form, click on Start out Now and go for the editor.

- Use the clues to fill out the suitable fields.

- Include your personal material and call details.

- Make confident that you just enter accurate information and figures in acceptable fields.

- Carefully check out the information belonging to the variety in the process as grammar and spelling.

- Refer to aid part if you have any issues or tackle our Assistance crew.

- Put an electronic signature on your VA Form 26-4555 together with the aid of Sign Instrument.

- Once the shape is completed, press Accomplished.

- Distribute the ready variety through email or fax, print it out or help save on the equipment.

PDF editor lets you to definitely make adjustments towards your VA Form 26-4555 from any net connected product, customise it as per your preferences, signal it electronically and distribute in several techniques.